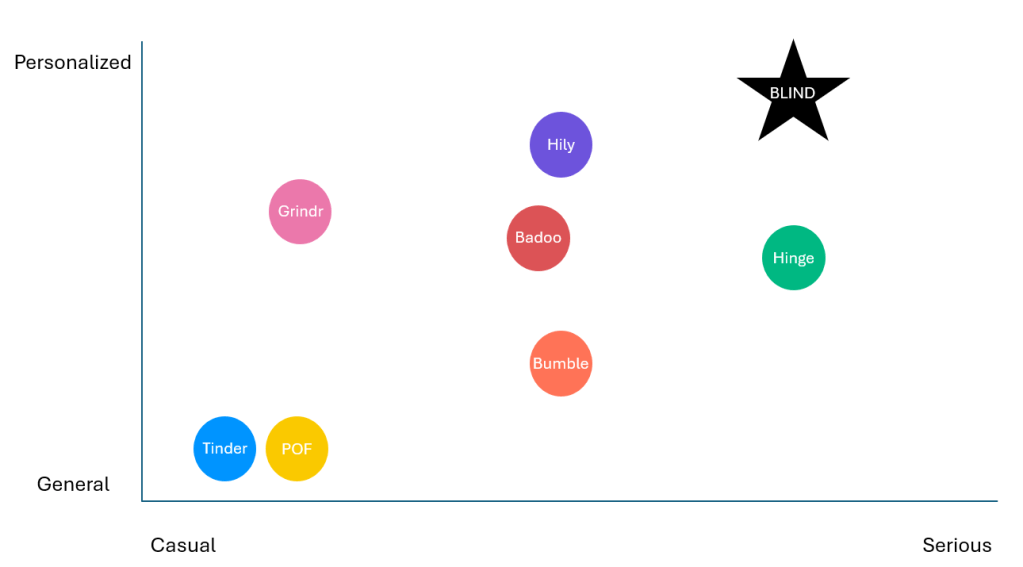

The dating app market is a multi-billion dollar, rapidly growing industry with significant unmet user needs. In this section, we’re going to dive into the journey of making a blind dating app together—exploring how BLIND focuses on personality compatibility and real-world dating experiences to redefine what online dating can be.

Market Overview

- The global online dating market was valued at approximately $10.28 billion in 2024 and is projected to grow to $19.33 billion by 2033, driven by advances in AI personalization and increasing acceptance of online dating.

- The Compound Annual Growth Rate (CAGR) is estimated at around 7.27%, based on triangulated data from top-tier market research firms.

- The US market alone represents a substantial portion, with approximately 30% adult penetration and a projected value exceeding $2 billion by 2030.

From the graph below, we see that Tinder and Bumble together dominate almost half the US dating app market (49%). However, the other half of users—nearly 50%—are spread across alternative platforms like Hinge, Plenty of Fish, Grindr, Hily, Badoo, and various niche apps, as well as a significant “Other” segment.

This distribution suggests a critical insight: many users are actively trying out alternatives. This points to clear dissatisfaction and unmet goals with the traditional industry leaders. It signals that Tinder, Bumble, and similar apps may not be serving user needs for meaningful, sustained connections, prompting users to seek potentially better experiences elsewhere.

- Tinder: The undisputed “hookup leader,” well known for being fast, casual, and appearance-focused.

- Bumble: Known for its female-first message, positioned between hookups and relationships.

- Hinge: Brand message “Designed to be Deleted”—emphasizing seriousness and relationship intent.

- Plenty of Fish (POF): Mass-market for value-conscious users, more generic, less brand identity.

- Grindr: Niche app for LGBTQ+ users, major presence among men seeking men.

- Hily & Badoo: Social discovery, playful, appeal to Gen Z and international audiences.

User Behavior & Pain Points

- 78% of dating app users report app fatigue and burnout, indicating widespread dissatisfaction with current superficial and time-consuming platforms.

- A significant gender imbalance exists, with male users receiving far fewer matches, creating frustration and high churn.

- Safety concerns are prevalent, with nearly half of users demanding enhanced verification and authenticity features.

- Existing apps suffer from low real-world date conversion rates, typically only 5-8% of matches result in actual meetings.

BLIND’s Response

- The app designs time-limited blind date interactions to reduce fatigue.

- It uses guaranteed matching algorithms to address male user matchmaking disparities.

- Social media verification and photo validation resolve safety and authenticity concerns.

- Strategic restaurant partnerships aim to directly convert online matches into real dates.

Revenue Model Innovation

- Dating apps typically generate about 72% of revenue from subscriptions, with the remainder from in-app purchases and advertising.

- BLIND diverges by integrating restaurant partnerships through commissions on date bookings—a unique differentiator in the market.

- Premium subscriptions offering exclusive features such as unlimited matches and sneak peek.

- In-app purchases and verification premium services are expected to account for the remaining revenue streams, alongside advertising and event fees.